Table of Contents

Cheap Car Insurance In Australia

Hey Owners Do You Feel like you’re paying more on your car motors insurance than you should be right in your age? then You might be onto something.

We requested up to 10 quotes from 09 different car insurers as part of the 2021 Finder Awards in the whole world and in Cheap Car Insurance In Australia. Once we averaged everything out, the cheapest Comprehensive Car Insurance provider was $2,850 less than the priciest.

While one budget motor car insurer cost an average $625 a year for a comprehensive policy, another reached a huge $3,470 In a year!

Car insurance protects you against the financial, money loss for damages resulting from car accidents, theft, weather events, and other unforeseen costs according to your every insurance policy type. A car insurance policy helps pay for the cost of damage to cars, property, and even people. The Australian car insurance market is highly competitive in 2022, which can make it difficult for consumers to choose the right and cheap insurance policy for them.

also check:

Top 5 Cheap Car Insurance Options In Australia

In Australia so many companies are well established in insurance but we the team research so many car and motors insurance companies, then we find these best cheap car insurance companies so check these fantastic cheap best insurance for new drivers.

cheap auto insurance In Australia || 5 cheap car insurance options

| Rank | Brand | Annual premium cost | Apply |

|---|---|---|---|

| 1 | Bingle | $628.11 | Get quote |

| 2 | $781.19 | Get quote | |

| 3 | $853.92 | Check | |

| 4 | Coles | $1,021.51 | Check |

| 5 | $1,266.86 | Check |

How did we pick these affordable car insurance brands?

- We obtained quotes from Must of the cheap insurance quotes brands for the 2021 Finder Awards in February 2021.

- Products were assessed by obtaining prices across 6 different age and gender profiles with an approximate $750-$800 excess.

- We looked at all our Finder partners and listed the top 5 Car Insurance In Australia cheapest brands on Finder in September 2021.

Must read: Looking for the cheapest car insurance?

There is no single cheap car insurance that suits every driver in Australia. Factors that impact your cost include the make and model of your motor car, your age, your gender and your suburb of finance, and here we the team live learns will determine the lowest premium available to you. Keep in mind that we don’t compare every product in the market in Australia, but we hope that our articles gives you such as impressive information will allow you to compare your options and find the cheapest car insurance for you.

So let’s check the best car insurance for young drivers are here we listed below parents can check these low cost car insurance For their Child.

Bingle Car Insurance Company In Australia

Bingle is unique and innovative enough to shake up traditional car insurance in whole world. The company Providing best car insurance comparison sites online-only, no fuss, low cost car insurance for smart drivers and youngers drivers also.

Want to See Best Car In Australia Click Here

Budget Direct Car Insurance

Budget Direct Insurance Company also check the same things they provide cheap auto insurance online In Australia it comes with best top 5 cheap car insurance companies, so guys trust this company and looks on its.

- Comprehensive

- Third Party Property Only

- Third Party Property, Fire & Theft

On your first year’s premium for a new type policy purchased online Get a Quote

Virgin Money Car Insurance

Across the board, Budget Direct, Bingle and Virgin Money were some of the cheaper providers we came across.

They No-nonsense products gives to their customers proud of When it comes to banking, you want an honest deal with no surprises deal. So we’ll always tell you the things you really need to know up front and choose them because they gives low insurance quotes in Australia.

Coles Car Insurance

The Coles car motors Insurance is full of nice surprises Like the fact that they won the 2021 Canstar Award for Outstanding Value, Giving you reassurance and quality cover you can rely on.

99% Paid

They strive to put customers and their needs first – having paid out 99% of car claims last year.

One-week Repairs

Get back to what’s important with a one-week turnaround on the majority of repairs with Comprehensive Cover.

Read also these quotes from our best site: https://newzquotes.com/

Lifetime Guarantee

Feel at ease with a Lifetime Guarantee on all authorised repairs through our Partner Repairer Network.

This guide shows you how to compare car insurance the right way, so you can get a cheap deal that suits your needs. We’ll also share some tips on how to lower your premium, so you’ve got more money in your pocket every month.

How can I get the cheapest car insurance?

If you’re looking for a cheap car insurance policy that doesn’t hurt your pocket, there are a few things you can do to lower your premiums.

- Compare online. Don’t go with the first policy you find. Shop around and you could save thousands of dollars on your car insurance.

- Restrict drivers. Choosing not to let young drivers behind the wheel of your car can save you big bucks on your car insurance.

- Take a higher excess. You’ll have to pay more if it ever comes to making a claim, but taking a higher excess will lower your regular premiums.

- Pay annually. Some car insurers offer discounts if you’re able to pay your annual premium up-front rather than in monthly instalments.

- Keep your car in a garage. Your car is safer if it’s kept in a garage or in an off-street parking spot, so your premium should be less.

- Insure multiple vehicles. More than one car in your household? You can get cheaper insurance by bundling your policies.

- Insure more than your car. Insurers often offer multi-policy discounts if you bundle different insurance policies together. For example, you might have life insurance or home insurance with the same brand.

- Pay-as-you-go. If you don’t use your car much, consider a pay-as-you-drive insurance policy. They’re a cheaper alternative for people who seldom use their vehicles.

- Look for no claim bonuses. If you’re a safe driver, finding an insurer that offers no claim bonuses can make a big difference to your premium. With each year you have a clean claims record, your premium will be discounted.

- Reconsider your loyalty. Some insurers reward loyalty – but it’s not always the case. If you’ve been with your insurer a while, ask for a better price when it comes to renewal time. If the answer is no, compare your options and switch if you find a cheaper policy.

Some YouTube video To Understand the Car Insurance

How much does car insurance cost?

That’s pretty tricky to say, but we the team live learns always here to help you, because there are lots of different factors which influence the price of your car insurance now a days. like What car you have own, where you keep it from, all your driving history and the type of insurance policy you want are just a few things which can have a big impact on price the price of cheap insurance.

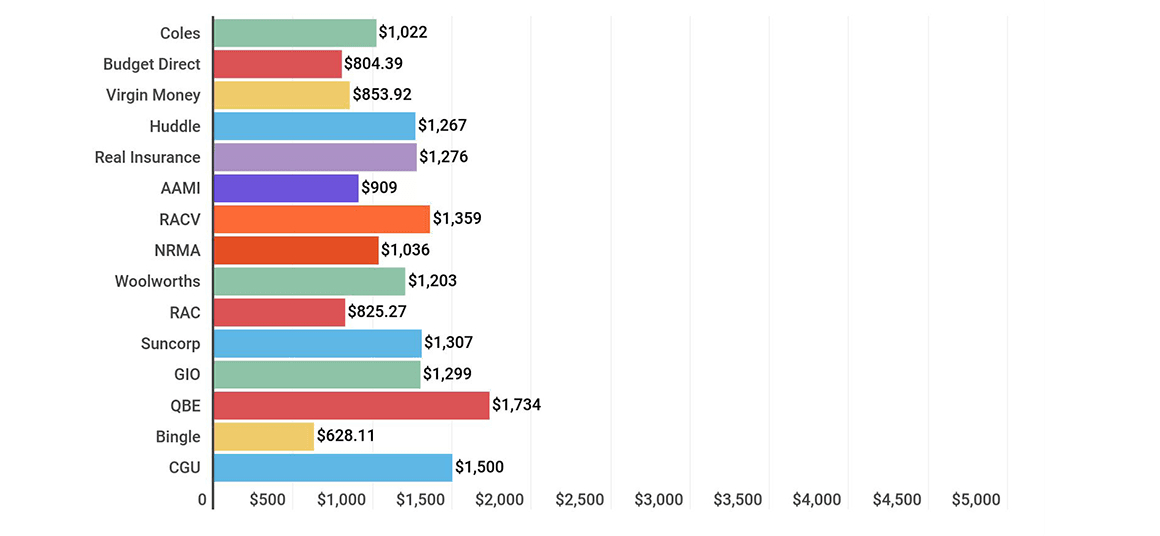

We requested up to 10 quotes from 08 different car insurers as part of the 2021 Finder Awards. Once we averaged everything out, the cheapest provider was $2,700 less than the priciest.

While one budget car insurer cost an average in Australia $620 a year for a comprehensive policy, another reached a huge $3,470 a year!

Running a car is expensive enough without pricey insurance to boot in 2022. Thankfully, there are heaps of options out there for cheap car insurance that won’t break the bank.

What’s the cheapest type of car insurance?

Third party car insurance is usually the least expensive option in insurance policy if you’re looking for a policy purely based on the price. However, you’ll get more for your money if you choose more comprehensive cover in 2022 best car insurance.

Here’s a breakdown of different types of car motors insurance policies and what they specially cover you for: check below

- Compulsory third party insurance (CTP): This is mandatory car insurance. You can’t get your car registered without it. It covers injuries and deaths suffered on the road accidents, but no vehicle damage of any sort here.

- Third party (TP): Third party car insurance covers damage you cause to other cars and property is yours fully. It doesn’t cover any damage to your own car at traveling so theat you can take travel insurance.

- Third party fire and theft (TPF&T): This type of car insurance typically costs more than just TP, but also covers your own vehicle from damage or loss that is the result of fire or theft, two of the most common vehicle hazards.

- Comprehensive: The highest level of car insurance. This protects you if you’re in an accident, a big storm trashes your car, or someone bumps your bodywork with their shopping trolley.

How Many Types of Car Insurance in Australia

In Australia their are 4 different types of car insurance in Australia. Below is an explanation of each of the different types of car insurance and help you decide what type of insurance you can consider.

1.Compulsory Third Party or “CTP” Insurance Explained

Third-party “CTP” insurance is a minimum requirement to drive in Australian states… and for good reason. CTP provides coverage for other people who get injured or die in an accident.

For example, if you’re walking down the road to the supermarket and a car runs off the road and hits you — that car is ‘in the wrong’ and needs to have cover for your costs — and the costs of damage to any other vehicles.

2.Third-Party Property Explained

Most third-party car insurance policies provide cover for other people’s property and cars, but not your car.

For example, if you crash your car into a parked car (you’re ‘in the wrong’ or ‘at fault’), your insurer will cover you for damages to the parked car and nearby property. But you can wave goodbye to your bomb — it won’t be covered.

Ensuring your car is important. So if you absolutely cannot afford comprehensive car insurance (see below), you should at least have 3rd party property insurance. This is usually the minimum standard of car insurance offered by Australian insurers.

Just imagine the look on your partner’s face if you t-boned Kyle Sandilands’ Ferrari without any insurance.

3.Third-Party Fire and Theft

Third-Party Fire and Theft is the same as Third Party Property except you’re covered if your car is stolen or damaged in a fire.

Depending on the policy, you may be able to ‘agree’ on a fixed value of the fire and theft level of cover — or it may be market value.

Say you have a car you bought last year for $10,000. This year, the ‘market value’ could be $9,000, with $1,000 taken off to represent the age of the vehicle.

If you have a ‘market value’ car insurance policy and you get a payout of insurance, you’ll probably receive whatever the insurer says it’s worth, based on the market value at the time. This is usually based on the average prices of cars of a similar make and model.

If you feel like your insurer isn’t giving you the right amount of money, go back to and tell them. When you do take evidence (industry reports, online advertising, expert reports, etc.) that shows your car is worth more. Even if you get an extra $500 in your payout, that’s $500 in your pocket!

An agreed value or agreed level of car insurance is exactly what it sounds like. When you take your policy with an insurer they might give you the option to insure your wheels for a set price.

For example, if you bought your car 6 months ago for $10,000 but the market value is $8,000 you might request to insure the car for $10,000.

4.Comprehensive Car Insurance

As they might say in Mexico, Comprehensive car insurance is “the whole enchilada”.

If you’re at fault, your Comprehensive car insurance provides cover for:

-Your car, plus

-The other person’s car, plus

-Property damage, and

-Covers you if your car catches fire or gets stolen

Again, sometimes you can agree on a fixed level of cover or market value, which can be determined as the current value of your car when it was crashed.

Who has the cheapest car insurance?

Based on our research for the 2021 Finder Awards, Bingle provides the cheapest car insurance when the quotes are averaged across all 6 Australian states. But if you’re in Victoria, you might need to pay a bit more for your car insurance compared to someone living in South Australia.

| Company Name | New South Wales | Queensland | South Australia | Tasmania | Victoria | Western Australia | Apply |

|---|---|---|---|---|---|---|---|

| $683 | $608 | $521 | $535 | $872 | $549 | Get quote |

Is there cheap car insurance in my state?

Based on our research, South Australia has the cheapest car insurance, where the average price of a comprehensive car insurance policy is $421 a year. Unfortunately, drivers in New South Wales may have to spend a little more, as the average is $4,520 a year.

However, the graph below shows just how much price can vary within each state on austrelia. If you don’t shop around, you could end up paying thousands more than you have to now a day in 2022, for a similar level of cover.

Which state has the cheapest car insurance?

Which state has cheap car insurance?

| Cheapest | Average | Most Expensive | |

|---|---|---|---|

| NSW | $683 | $1,532 | $4,582 |

| QLD | $608 | $1,132 | $3,442 |

| SA | $521 | $1,142 | $2,837 |

| TAS | $535 | $1,033 | $2,483 |

| VIC | $872 | $1,696 | $4,182 |

| WA | $549 | $1,178 | $3,346 |

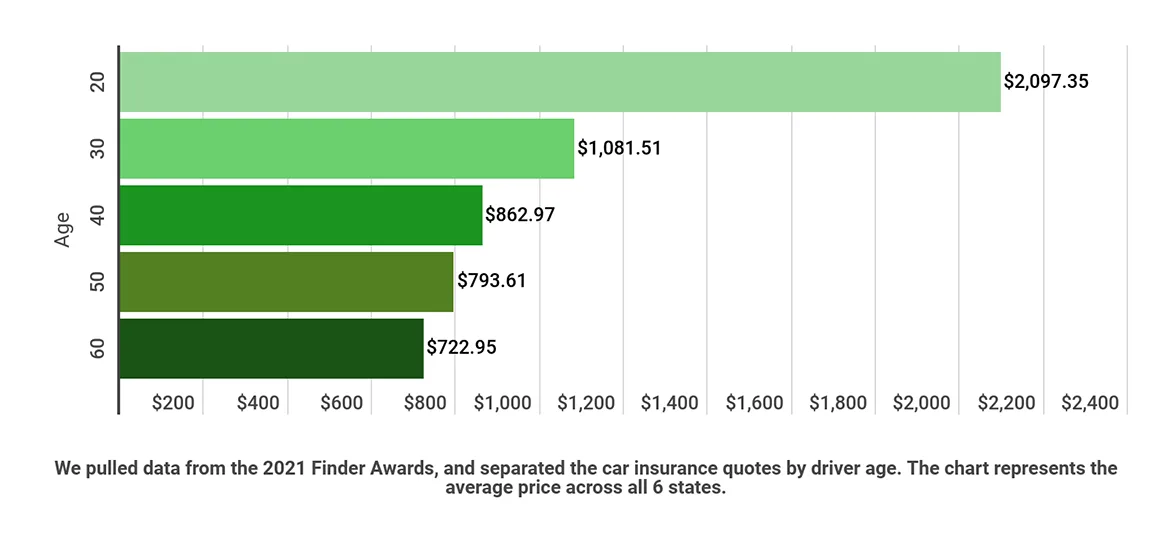

Can I get cheap car insurance at my age?

Your age has a pretty big impact on the price of your car insurance in 2022 – and it’s bad news for the youngsters out there. Insurance companies deem the younger drivers like age 18 to 20 at their higher risk than older drivers, so premiums are usually a bit pricier which makes it harder to find cheap car insurance.

Which age groups get cheap car insurance?

| Age | Average price |

|---|---|

| 20 | $2,097.35 |

| 30 | $1,081.51 |

| 40 | $862.97 |

| 50 | $793.61 |

| 60 | $722.95 |

I just need basic cheap car insurance

Third party car insurance is the most basic cover you can get, and it’s also the cheapest car insurance available. We requested quotes from 10 companies and found the average cost of a third party car insurance policy is just $32 a month, or $380 a year.

Remember: Third party car insurance will only cover the cost of damage to someone else’s car or property. It won’t cover any damage to your car.

How did we get these costs?

To determine this estimated cost, we sourced quotes using the profile of a female OR A MALE, Sydney-based driver born in 1981, who wants comprehensive car insurance for a Silver 2018 Toyota Corolla Hatchback Hybrid 5dr Auto.

The hypothetical driver has made no claims in the past 3 years and drives 10,000-15,000km annually. The Insurance policy start date was set at 15 September 2021.

Cheap car insurance: How much does third party insurance cost?

| Brand | Annual quote |

|---|---|

| Coles | $252.24 |

| Budget Direct | $397.33 |

| Virgin Money | $405.28 |

| CGU | $218.31 |

| Bingle | $308.39 |

| QBE | $323.15 |

| AAMI | $383.80 |

| GIO | $395.00 |

| Suncorp | $560.65 |

| NRMA | $552.21 |

Top 10 best car insurance companies in Australia

(Cheapest Quotes and Good Services)

1. Australian Seniors

2. Australian Warranty Network (AWN)

3. Youi Comprehensive Car Insurance

4. Budget Direct Gold Comprehensive Car Insurance

5. Integrity Extended Warranties

6. Real Insurance

7. Eric Insurance

8. Huddle Comprehensive Car Insurance

9. Woolworths Comprehensive Car Insurance

10. State Government Insurance Office (SGIO)

FAQs On Cheap Car Insurance In Australia

What are the best car insurance features to look out for?

This really depends on your car and the policy points you want to prioritise. However, there are some features you’ll often see included in comprehensive car insurance that could be useful beyond the standard cover for damages caused by accidents, weather events, fire, theft and malicious acts. While this is certainly not an exhaustive list, some of these features may include

Can young drivers get the best car insurance?

Young or inexperienced drivers are often slapped with higher premiums and excess levels to account for their statistically higher likelihood of getting involved in an accident and making an insurance claim. However, they can generally still take out full-coverage policies with solid cover at an accessible price, especially if they can take advantage of various discounts.

13 thoughts on “Top 10 Cheap Car Insurance In Australia”